Introduction

In the digital economy, micropayments are not just a financial innovation but a transformative force. Traditional payment methods have yet to be a feasible option for these small transactions, but they can become a reality enabled by Bitcoin and its innovative offshoot, the Lightning Network.

This article delves into the multifaceted world of micropayments, exploring their vast potential and the technologies that make them possible.

Micropayments enable and transform Industries

Micropayments can enable new business cases and industries and transform and make others who were struggling to survive economically viable. Some of these cases are starting to happen with different legacy solutions, but they will blossom when a proper and universal micropayment technology is deployed.

These are some of these industries and use cases:

- Transforming content monetization. Micropayments can revolutionize how content is consumed and monetized online. They empower content creators, including writers, artists, musicians, and YouTubers, to earn from their audience for every content consumed without the constraints of traditional subscription models. This approach offers consumers access to a more diverse range of content tailored to their interests and fairly compensates creators for every view or read.

- Reinventing news and journalism. In journalism, micropayments can breathe new life into the industry. They enable readers to access individual articles for small fees, supporting quality journalism and investigative reporting. This model presents a sustainable financial alternative to the industry, combating the challenges of the free information age.

- Facilitating peer-to-peer payments. Micropayments enhance peer-to-peer (P2P) transactions by allowing small amounts to be transferred directly between individuals with minimal cost and high efficiency. This makes P2P exchanges more practical and accessible for everyday transactions, encouraging broader financial participation and cooperation.

- Data monetization. Consumers can now be compensated for their attention and data, creating a new economy centered around ethical data practices where consumers can choose and monetize their self-generated data, offering it in exchange for micropayments, opening new avenues for personal revenue generation. This data can be generated by consumer's devices, wearables or web and app usage.

- In-App purchases. Micropayments in the context of apps and games, can enable users to make in-app purchases for virtual goods or additional content, providing a more flexible and user-friendly experience than traditional payment models.

- Empowering the gig economy. The gig economy can benefit significantly from micropayments, enabling freelancers and independent contractors to receive real-time payments for completed tasks. This system eliminates the need for delayed payouts, providing a more sustainable financial model for gig workers.

- Supporting micro-donations. Charities and non-profit organizations can leverage micropayments for micro-donations, allowing supporters to contribute small, frequent amounts, leading to a substantial cumulative impact over time.

- Energy trading. Micropayments in the energy sector can allow for efficient trading of small amounts of energy, such as electric vehicle charging. This enables more granular and efficient energy transactions, fostering a more sustainable and decentralized energy market.

- Unleashing the Internet of Things potential. IoT devices can use micropayments to access specific services or data. An example is a smart fridge paying a small fee to access a recipe database.

Historical challenges

Historically, the high transaction fees and batch processing of conventional payment systems like credit cards have made micropayments impractical.

Non-card-based micropayment solutions have faced significant challenges that have prevented their success. Numerous companies at the beginning of the Internet era, like BitPass, First Virtual Holdings, Cybercoin, Millicent, Digicash, Pay2See, Flooz, and Beenz, tried creating alternative micropayment models, but they struggled due to several factors:

- Market Resistance: A key issue was the reluctance of other internet companies to adopt micropayments, as they were already generating sufficient revenue through advertising models.

- Consumer Expectations: The expectation of free web content among consumers posed a substantial challenge, making introducing a paid micropayment system difficult.

- Scalability and Integration Issues: Many of these systems faced problems with scalability and integration into existing digital environments. The reliance on batching transactions, which could only be processed after some time, further complicated their practicality and efficiency.

Even more modern companies have shared the same problems. The main challenge is the necessity to interact with the traditional financial rails for settlement and clearing.

If you touch the legacy systems, you are inherently acquiring its limitations. Having a minimum fee per transaction forces you to aggregate and batch processing the consumer transactions to share the costs. This aggregation requires the introduction of an artifact on the consumer side that represents money. In many cases, as a consumer, you have to pre-pay for this virtual money.

This architecture introduces a lot of friction for the onboarding and provokes an egg-and-check scenario. On the one hand, it's hard to integrate merchants that accept your virtual money if there are not enough consumers. On the other hand, the consumers are not incentivized to purchase this money with no merchants to buy with.

The Lightning Network: a catalyst for micropayments

The advent of blockchain technology and the Bitcoin Lightning Network has begun overturning these challenges, presenting a viable, efficient alternative for small-scale transactions.

The Lightning Network, a second-layer solution built on the Bitcoin blockchain, addresses the critical issues of traditional micropayment solutions. Minimal transaction fees and immediate transfers (with immediate final settlement) make micropayments feasible, efficient, and scalable. Its decentralized nature ensures a robust, universally applicable solution catering to a global audience.

Furthermore, Bitcoin is an asset with an intrinsic and accepted value that significantly differs from previous attempts to introduce a valueless token representing money.

While promising, the Lightning Network faces the challenge of adoption on the consumer side and the complexity of managing a node on the merchant side. However, the emergence of user-friendly Lightning wallets (like Alby and Wallet of Satoshi, among many others) has significantly lowered these barriers, enhancing the accessibility and usability of the technology for everyday transactions.

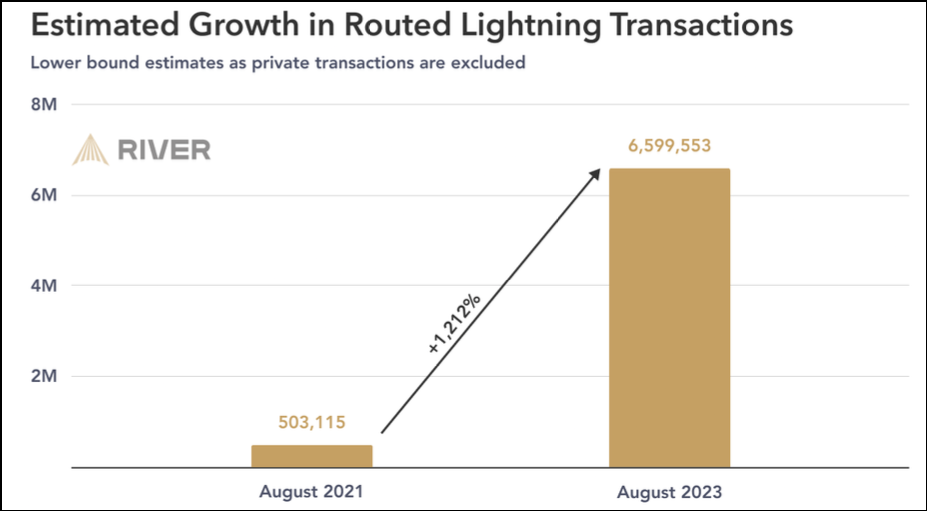

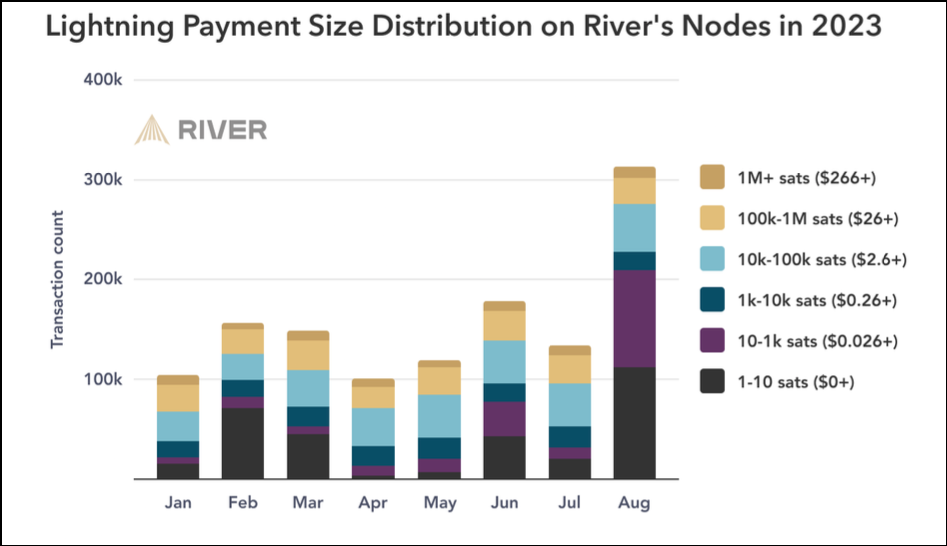

In any case, we have metrics on the Lightning Network that strongly suggest that adoption (1200% annual growth in the number of transactions) and the use case for micropayments (high percentage of transactions below one dollar) are going the right way, as you can see in these graphics from a report published by River on October 2023.

Case tudy: Nostr and Zaps

A practical example of micropayments in action is the use of 'Zaps' on platforms like Nostr, a decentralized social network. Here, users can send small payments or 'Zaps' to content creators using the Lightning Network, demonstrating the viability and potential of micropayments in content monetization and social media interactions.

Sites like Zapalytics and Nostr.band allow you to see the evolution on number and size of these small tips.

Conclusions

Integrating micropayments into various industries marks a significant shift in the digital economy. From empowering content creators to pioneering new forms of data monetization, the potential of these tiny transactions is vast. As technologies like the Lightning Network continue to evolve and gain traction, we can expect an expansion of use cases where minuscule payments substantially impact. The era of micropayments, championed by Bitcoin and its offshoots, is not just about financial transactions; it's about reshaping business models, consumer interactions, and the very fabric of the digital marketplace.